- Family household budget movie#

- Family household budget software#

- Family household budget free#

It’s one of those things I wish they had taught me in school. The point is simply to make sure you aren’t spending money you don’t need to.It’s not easy to manage your family household budget.

Obviously, the percentage you spend will vary for example, for groceries it will vary depending on things like the price of groceries, your family size, and any special nutritional needs. X Research source If you are spending more than that, you should consider cutting back on that spending. For example, food purchases should only take up 5 to 15 percent of your budget. Regular expenditures should usually only take up so much of your income. Even your essentials section should be looked at closely. Once you’ve spent that $40, you can’t go to any more movies until the next month. Family household budget movie#

For example, if you routinely go to the movies, set a budget of $40 a month for movie tickets. However, setting a budget and sticking to it will help keep that spending in check. X Expert Source Samantha Gorelick, CFP®įinancial Planner Expert Interview. It’s fine to budget for discretionary spending - you can’t live a life without any fun.Pick a set amount that you cannot go over each month and stick to it. Set limits on discretionary spending in particular. Target specific areas of your spending to decrease. This type of program can be an easy, painless way to save a little bit each month. It will also match a certain percentage of this savings. This program rounds up each transaction you make with your debit card and transfers the difference into your savings account.

Family household budget free#

Some banks have free savings programs you can enroll in, such as Bank of America’s "Keep the Change" program. Adjust the savings amount as necessary, or, better yet, adjust your spending if possible! Money you save can later be used to invest or you can save with some other purpose in mind, like buying a home, college tuition, vacations, or anything else. Don’t wait for there to be money left at the end of the month. We all are too familiar with arriving at the end of the month and having nothing left over. This is enough to make your savings grow fairly quickly while not so much that it will crimp other areas of your life. A great target is 10% of your paycheck. While not everyone can afford to save money on a regular basis, everyone should have it as a goal and do it if they possibly can. You may want to investigate this option if regularity is important to you. Some utility companies will allow you to pay average amounts all year, instead of having your bill fluctuate each month.

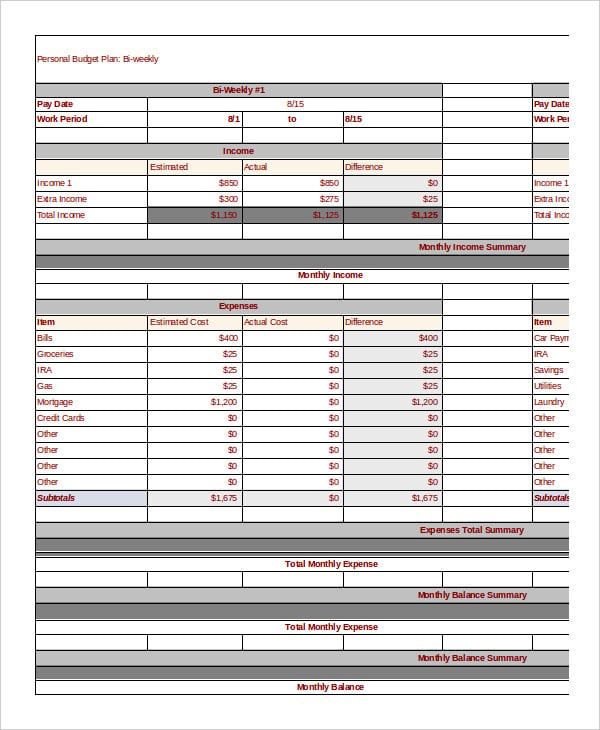

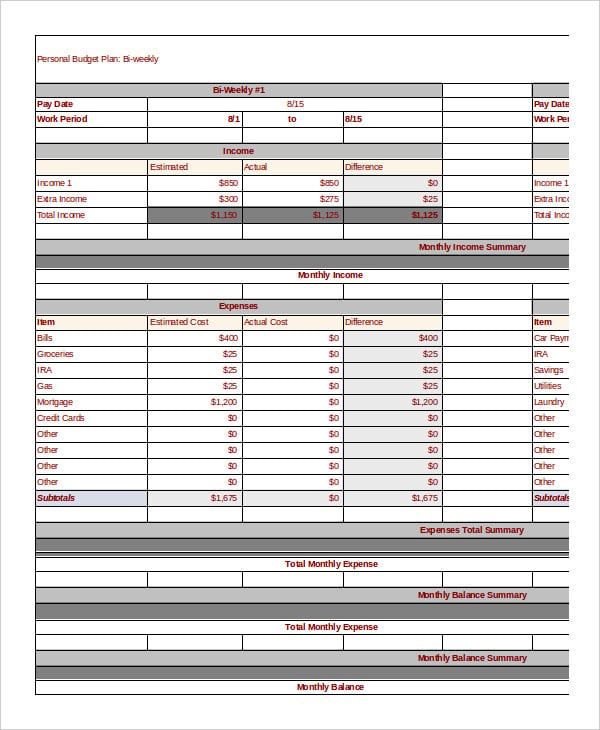

Try to either round up or down to the nearest $10 for an average estimate on how much you spend for each item.Put in an estimate of your recurring bills (perhaps what you paid the previous year for that specific expense) but once the bill comes and you pay it, put the actual amount into your ledger. Some bills, such as your rent or mortgage, usually stay the same every month, while others are more variable (like utilities).Put in estimates as placeholders until the actual bills come. Installation payments, such as student loans and credit cards, also go in here. Some examples would be car payments, rent or mortgage, utilities (such as water, electricity, etc), and insurance (medical, dental, etc). Put your biggest regular expenses into the spreadsheet or ledger.

Family household budget software#

If you are using software you will be able to add rows easily to fit all of your expenses in.

If you are using a paper ledger, you may want to create a separate page for each of these categories, depending on how many expenses you have in each category every month. Software will also allow you to divide your spending into different time periods and priorities.

Using a software program to do this has the added benefit of being able to easily categorize the type is spending (groceries, gas, utilities, car, insurance etc) as well as calculating totals in different ways that are useful to understand what, when, where, how much and how (credit card, cash, etc) you spend. Transportation (car, gas, public transport costs, insurance). Household Operations, such as lawn or maid service. Utilities, such as electricity, gas, and water. Rent/Mortgage (make sure to include any insurance). Common categories include: X Research source This will help you when you go to input your expenses and when you want to look through them for a specific expenditure. Each entry should go into a category so you can easily see how much you spend on monthly and yearly bills, regular essentials, and discretionary costs.

Using a software program to do this has the added benefit of being able to easily categorize the type is spending (groceries, gas, utilities, car, insurance etc) as well as calculating totals in different ways that are useful to understand what, when, where, how much and how (credit card, cash, etc) you spend. Transportation (car, gas, public transport costs, insurance). Household Operations, such as lawn or maid service. Utilities, such as electricity, gas, and water. Rent/Mortgage (make sure to include any insurance). Common categories include: X Research source This will help you when you go to input your expenses and when you want to look through them for a specific expenditure. Each entry should go into a category so you can easily see how much you spend on monthly and yearly bills, regular essentials, and discretionary costs.

0 kommentar(er)

0 kommentar(er)