These payments include all required Employment Security, Job Development Fund, Reemployment Fund and Temporary Disability Insurance taxes.

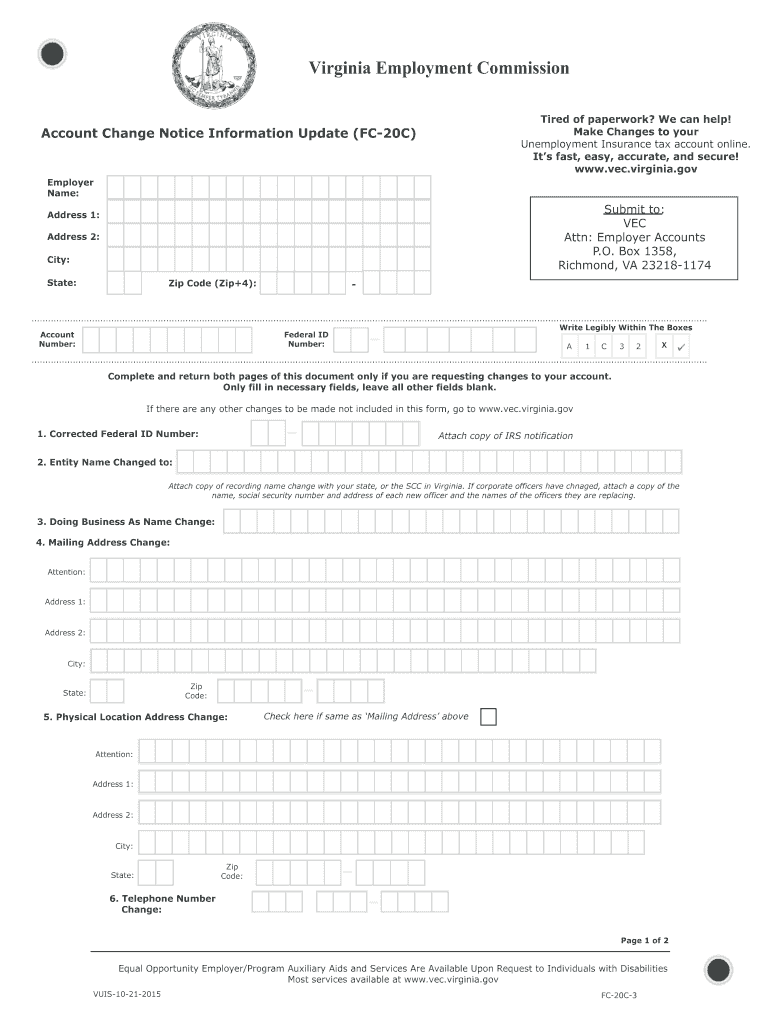

The federal government oversees the general administration of state unemployment insurance programs. The Employer Tax Unit processes all Quarterly Tax and Wage Reports (Form TX-17) and accompanying tax payments, submitted by Rhode Island employers. While you receive benefits, your job is to get.

#Unemployment tax form free#

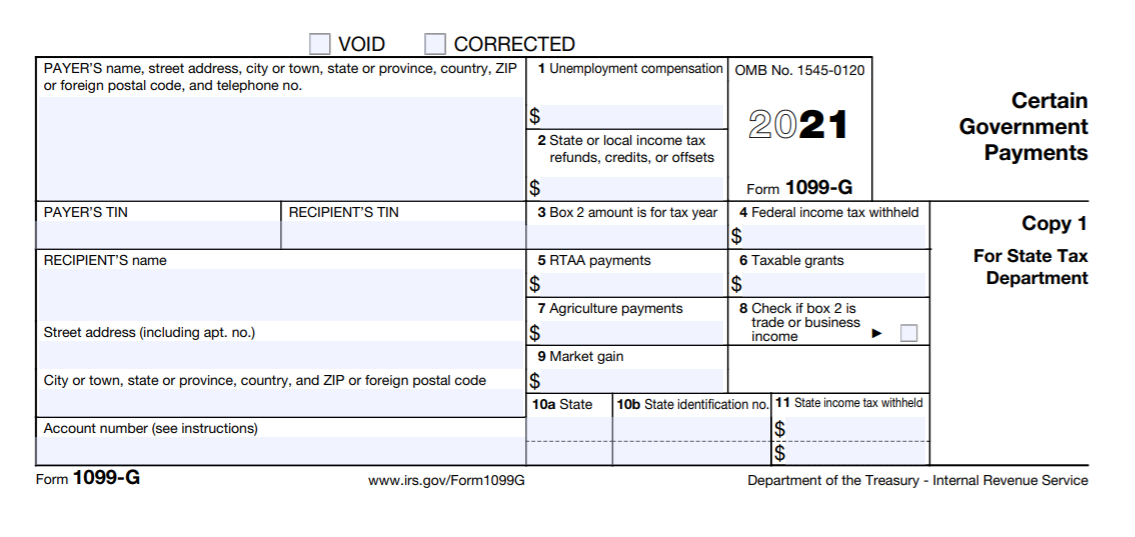

If you have received an incorrect 1099-G form or if you believe you are a. Applications may be downloaded by choosing one of the forms below or by calling toll free 84 and pressing option 2 for Employer Taxes and Employer Accounts. The benefits, from taxes your former employer (s) paid, are not based on financial need. The 1099s reflecting unemployment benefits paid in 2021 were generated on. The money partly replaces your lost earnings and helps you pay expenses while looking for new work. Qualifying individuals receive unemployment compensation as a percentage of their lost wages in the form of weekly cash benefits while they search for new employment. Unemployment benefits provide you with temporary income when you lose your job through no fault of your own. Unemployment insurance refers to a joint federal and state program that provides temporary monetary benefits to eligible laid-off workers who are actively seeking new employment. The IRS and some states consider unemployment compensation to be taxable income, that you are required to report on your federal tax return. 31, but Michigan received an extension from the IRS that allowed the state until the end of February to make the forms available. ILogin is required to view your 1099-G form online. If you received any unemployment benefits in 2021, you will need the 1099-G tax form to complete your federal and state tax returns. If you opted to receive communications through USPS mail, your form will have mailed by February 1st, 2022.

#Unemployment tax form pdf#

Follow these steps to enter info from Form. This delay led to the Great Depression, which lasted 10 years and led to a 25 unemployment rate 48 KB) If you will be visiting our office, call 1-87 during normal business hours, to set up an appointment Form Name PDF WPD DOC Fillable PDF Net Worth Statement rev of the Professions, Nurse Unit, 89 Washington Avenue. 1099-G tax forms are now available to download online. States normally have to publish 1099-G forms by Jan. Form 1099-G is commonly used to report unemployment compensation and state or local income tax refunds received. The form includes information on the amounts of benefits claimants received and the amounts of taxes withheld from benefit payments. Residents who claimed unemployment benefits in 2021 have to have the form to file state and federal tax returns.

22, 2022, that 1099-G forms are available for anyone who received unemployment insurance benefits in 2021. The Michigan Unemployment Insurance Agency announced Feb.

0 kommentar(er)

0 kommentar(er)